Understanding QuickBooks and Its Benefits for Small Businesses

- admin744386

- Dec 29, 2025

- 3 min read

Small business owners often face the challenge of managing their finances efficiently while focusing on growth and customer satisfaction. QuickBooks offers a practical solution to this problem by simplifying accounting tasks and providing clear financial insights. This post explains what QuickBooks is and why it can be a valuable tool for your small business.

What is QuickBooks?

QuickBooks is an accounting software developed by Intuit, designed to help small and medium-sized businesses manage their financial operations. It covers a wide range of accounting needs, including:

Tracking income and expenses

Managing invoices and payments

Handling payroll

Preparing tax reports

Monitoring cash flow

The software comes in different versions, such as QuickBooks Online and QuickBooks Desktop, allowing businesses to choose the option that fits their needs and preferences.

How QuickBooks Simplifies Financial Management

Managing finances manually or with spreadsheets can be time-consuming and prone to errors. QuickBooks automates many accounting tasks, which helps business owners save time and reduce mistakes. Here are some ways QuickBooks simplifies financial management:

Automated invoicing: Create and send professional invoices quickly, and track payments.

Expense tracking: Link bank accounts and credit cards to automatically import and categorize expenses.

Real-time reports: Access up-to-date financial reports like profit and loss statements, balance sheets, and cash flow summaries.

Tax preparation: Organize financial data to make tax filing easier and more accurate.

By automating these processes, QuickBooks allows business owners to focus on running their business rather than wrestling with paperwork.

Benefits of Using QuickBooks for Small Businesses

1. Saves Time and Reduces Errors

Manual bookkeeping takes hours and increases the risk of mistakes. QuickBooks automates calculations and data entry, which speeds up accounting tasks and improves accuracy.

2. Improves Financial Visibility

QuickBooks provides clear, real-time insights into your business’s financial health. You can quickly see which products or services are most profitable, monitor cash flow, and identify areas where costs can be cut.

3. Supports Better Decision Making

With detailed reports and dashboards, QuickBooks helps you make informed decisions. For example, if sales drop in a particular month, you can analyze expenses and adjust your budget accordingly.

4. Facilitates Tax Compliance

QuickBooks organizes your financial data to simplify tax preparation. It tracks deductible expenses and generates reports that accountants can use to file taxes accurately, reducing the risk of audits or penalties.

5. Scales with Your Business

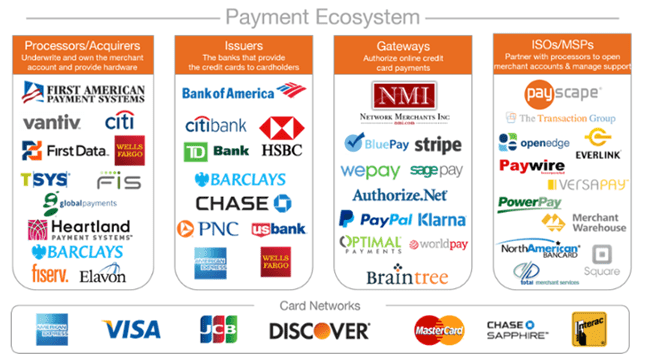

As your business grows, QuickBooks offers additional features and integrations. You can add payroll services, inventory management, and connect with other apps like payment processors or CRM tools.

Practical Examples of QuickBooks in Action

Consider a small retail store owner who uses QuickBooks Online. The software automatically imports sales data from the store’s payment system and categorizes expenses like rent, utilities, and supplies. The owner receives monthly profit and loss reports that highlight which product lines generate the most revenue. When tax season arrives, the owner exports all necessary financial reports directly from QuickBooks, saving hours of manual preparation.

Another example is a freelance graphic designer who uses QuickBooks Desktop. The designer creates invoices for clients, tracks payments, and monitors overdue accounts. QuickBooks also helps estimate quarterly taxes, so the designer avoids surprises at tax time.

Choosing the Right QuickBooks Version

QuickBooks offers several versions tailored to different business needs:

QuickBooks Online: Cloud-based, accessible from any device with internet, ideal for businesses that want flexibility and automatic updates.

QuickBooks Desktop: Installed on a computer, preferred by businesses that want more control and advanced features.

QuickBooks Self-Employed: Designed for freelancers and independent contractors with simple income and expense tracking.

Evaluate your business size, industry, and accounting needs to select the version that fits best.

Getting Started with QuickBooks

Starting with QuickBooks is straightforward. Most versions offer free trials, allowing you to explore features before committing. Here are some tips to get started:

Set up your company profile with accurate business details.

Connect your bank and credit card accounts for automatic transaction imports.

Customize invoices with your logo and payment terms.

Regularly review reports to stay on top of your finances.

Consider consulting an accountant to optimize your QuickBooks setup.

Final Thoughts on QuickBooks for Small Businesses

QuickBooks is a powerful tool that helps small businesses manage their finances efficiently. It saves time, reduces errors, and provides clear financial insights that support better decision making. Whether you run a retail store, freelance business, or service company, QuickBooks can adapt to your needs and grow with your business.

Comments