Top 5 Merchant Services Options for Your Business and Their Fees

- admin744386

- Dec 30, 2025

- 3 min read

Setting up merchant services is a critical step for any business that wants to accept payments smoothly and securely. Choosing the right merchant service provider can impact your cash flow, customer experience, and overall profitability. This post explores the top five merchant services available today, breaking down their features and associated fees to help you make an informed decision.

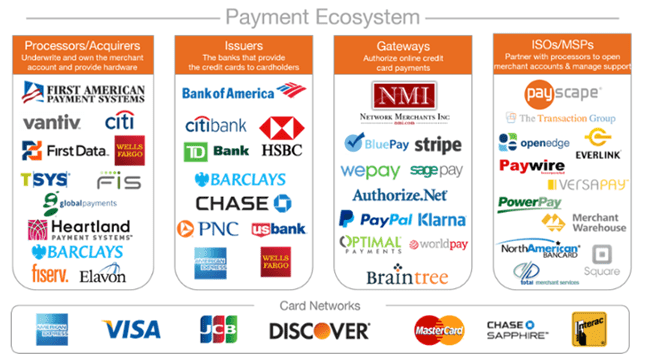

What Are Merchant Services?

Merchant services refer to the financial services that allow businesses to accept and process payments from customers, typically through credit and debit cards. These services include payment gateways, point-of-sale (POS) systems, and transaction processing. Selecting the right provider means balancing cost, ease of use, and reliability.

1. Square

Square is popular among small to medium-sized businesses for its simplicity and transparent pricing. It offers a free POS app and hardware options like card readers and terminals.

Fees: Square charges a flat rate of 2.6% + 10 cents per swipe, dip, or tap for in-person transactions. Online payments cost 2.9% + 30 cents per transaction.

Features: No monthly fees, easy setup, and free software updates.

Best for: Retail shops, food trucks, and service providers who want straightforward pricing without long-term contracts.

2. PayPal Here

PayPal Here integrates with the widely used PayPal platform, making it convenient for businesses that already use PayPal for online payments.

Fees: 2.7% per swipe, dip, or tap for card-present transactions. Online payments through PayPal standard rates apply, usually around 2.9% + 30 cents.

Features: Mobile card reader, invoicing, and access to PayPal’s buyer and seller protections.

Best for: Businesses with an existing PayPal customer base or those selling both online and in person.

3. Stripe

Stripe is known for its developer-friendly platform and is ideal for businesses with online sales or custom payment needs.

Fees: 2.9% + 30 cents per successful card charge for online payments. In-person payments via Stripe Terminal are 2.7% + 5 cents.

Features: Highly customizable, supports subscriptions, and multi-currency payments.

Best for: E-commerce businesses and startups needing flexible payment integration.

4. Shopify Payments

Shopify Payments is built into the Shopify e-commerce platform, simplifying payment processing for online stores.

Fees: 2.9% + 30 cents per online transaction for the basic plan. Lower rates apply for higher-tier plans.

Features: Seamless integration with Shopify stores, fraud analysis, and multi-channel selling.

Best for: Shopify store owners looking for an all-in-one solution without third-party payment gateways.

5. Clover

Clover offers a range of hardware options and a customizable POS system suitable for various business sizes.

Fees: Typically around 2.3% to 3.5% per transaction depending on the plan and hardware used. Monthly fees range from $9.95 to $39.95.

Features: Flexible hardware, app marketplace for added functionality, and detailed reporting.

Best for: Businesses needing a robust in-store POS with hardware options and add-ons.

How to Choose the Right Merchant Service

When selecting a merchant service, consider these factors:

Transaction volume: High-volume businesses may benefit from lower percentage fees or monthly plans.

Sales channels: If you sell both online and in person, look for providers that support both seamlessly.

Hardware needs: Some services offer free or affordable card readers; others require purchasing equipment.

Ease of use: User-friendly interfaces reduce training time and errors.

Customer support: Reliable support can save time and money during technical issues.

Final Thoughts on Merchant Services

Choosing the right merchant service can save your business money and improve customer satisfaction. Look beyond just fees and consider how the service fits your sales model and growth plans. Testing a few options with trial periods or demos can also help you find the best match.

Comments